Every month the FOX Portfolio & Solutions team will bring you strategic marketing intelligence, insights, and solutions that focus on your brand needs and marketplace trends. This month’s update focuses on the cryptocurrency industry and shares some key findings on the latest research, what’s new in the industry and how your brands can break through with the power of the FOX Portfolio. Below you’ll find the category insights newsletter on Finance.

CATEGORY REVIEW & OUTLOOK

MAGNA is forecasting financials total ad spend to be up +6% YoY in 2022. Following a double-digit increase in 2021, linear dollars are expected to be flat in 2022.1 While digital spending grew over +40%, in the first two months of 2022, on strength across all subcategories TV dollars were down -7% on lower insurance spending.2

Healthy household balance sheets and a strong labor market should support continued consumer spending. However, the biggest concern today is rising inflation, which is at a 40-year high. With the Fed expected to hike interest rates as many as seven times this year to curb escalating prices. Rapidly rising rates could also slow down economic growth, with some economists seeing a growing probability of a recession in the U.S. over the next year.

KEY TRENDS

- Faster Adoption of Digital and Mobile Banking

- Data-Driven and More Personalized Products & Services

- Further Innovation & Competition in all Aspects of Finance

- Rising Concerns on Trust, Privacy and Cybersecurity

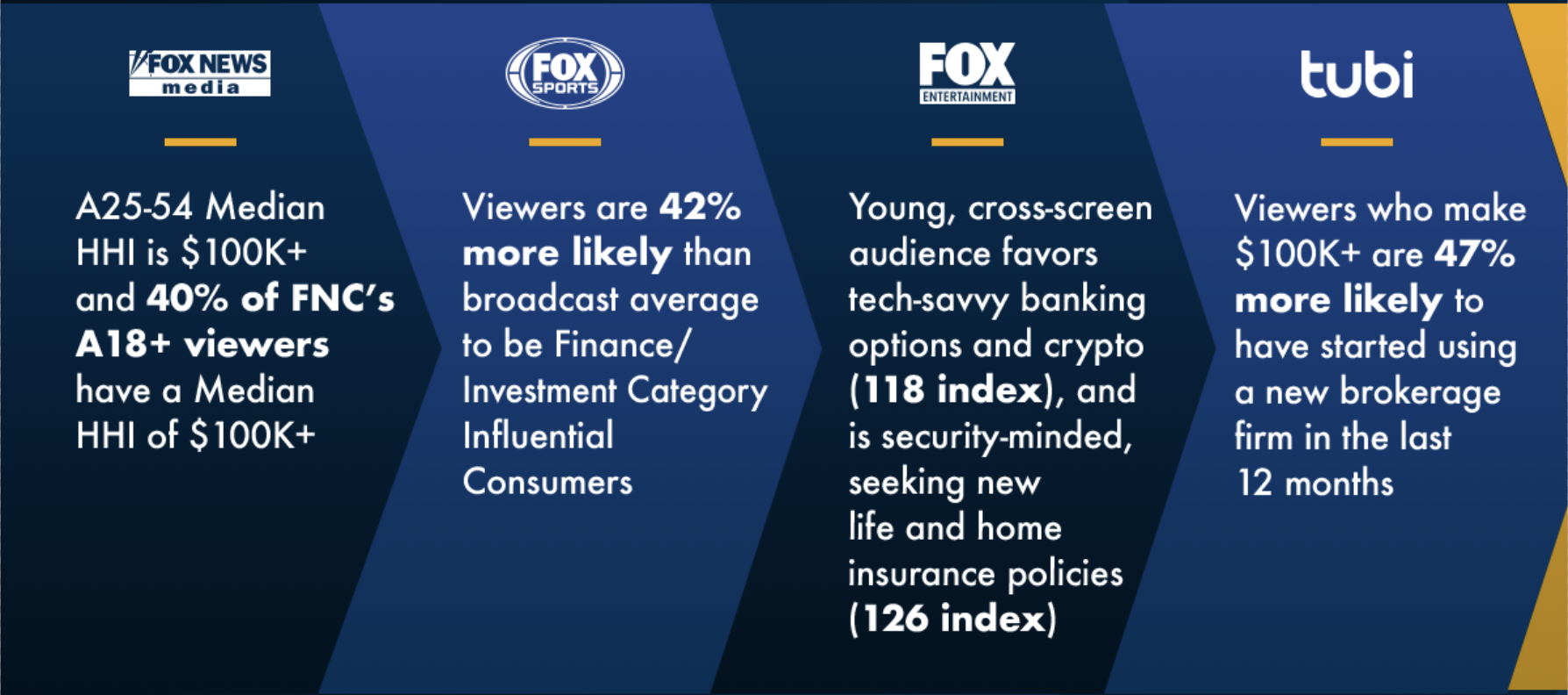

MORE IS POSSIBLE WITH THE POWER OF FOX

CATEGORY HIGHLIGHTS

INSURANCE

Following record performance in 2020 from reduction in driving activity, large auto insurers mostly reported lower profits in 2021 due to an increase in claims frequency. Rising prices for replacement, repair and labor are also driving higher housing and auto insurance claims costs. Due to the array of rising costs, many insurers are planning to raise premiums in 2022 to remain profitable.

BANKING & LENDING

Mortgage volume more than doubled from 2019 to 2021 on the back of record-low rates. With interest rates on an upward trend since the start of 2022, total mortgage market is expected to drop to $2.6T in 2022 from $3.9T in 2021.6 Cash-out refi and purchase mortgages are projected to perform slightly better than refinancing, which is highly sensitive to rate increases. Card companies noted transactions and applications have picked up and have led to a more competitive environment, especially regarding rewards and marketing.

INVESTING

The financial markets performed exceptionally well in 2021 across a broad range of asset classes. First-time investors who opened accounts and started trading during the pandemic are jumping into more complex investment products. Even as sentiment has become more mixed due to economic uncertainties and market volatility, providers from crypto startups to large financial institutions are investing heavily to grab share and become the financial platform of choice for the new crop of investors

For Questions or more detail

Please contact the FOX Portfolio Strategy & Solutions team to help you with strategic marketing intelligence, insights and solutions.

STEPHANIE CHUA | Director, Portfolio Strategy & Solutions | stephaniekline.chua@fox.com

JEFF FOSTER | Senior Manager, Portfolio Strategy & Solutions | jeff.foster@fox.com

RISTEN CLARKE | Specialist, Portfolio Strategy & Solutions | risten.clarke@fox.com