Topics

Insights, Category Outlook

Spotlight

Properties

Platforms & Partnerships

Entertainment Programming

Insights and Innovations

Partnerships & Integrations

Streaming and Sponsorships

Research & Insights

Experiences and Innovations

Partnerships & Integrations

Spotlight

Programming

Ad Products

Partnerships

Are you sure you want to logout? In order to log back in you will need to re-authenticate your account. This includes another SMS/Text Authentication Message sent to your cell phone number.

Every month the FOX Portfolio & Solutions team will bring you strategic marketing intelligence, insights and solutions that focus on your brand needs and marketplace trends. This month’s update focuses on the Restaurant Industry and shares some key findings on the latest restaurant trends, what’s new in the industry and how your brands can break through with the power of the FOX Portfolio. Below you’ll find the Restaurant Category Insights Newsletter.

The restaurant industry continues to face unique challenges with labor and food supply shortages affecting all aspects of quick service, fast food, and high-end dining. With these challenges, restaurants and food delivery services are adapting and innovating to keep up with the rapidly changing demands.

MAGNA is expecting the Restaurant category total ad spend to rebound +7% in 2022. The industry is beginning to return to pre-pandemic levels with restaurants posting their third consecutive month of positive sales growth in May compared to the same time in 2019 (1). However, overall recovery could be hampered by higher menu prices due to a variety of factors including rising labor costs and food ingredients. The industry has also been boosted by stimulus checks, which could wear off in the second half of 2021.

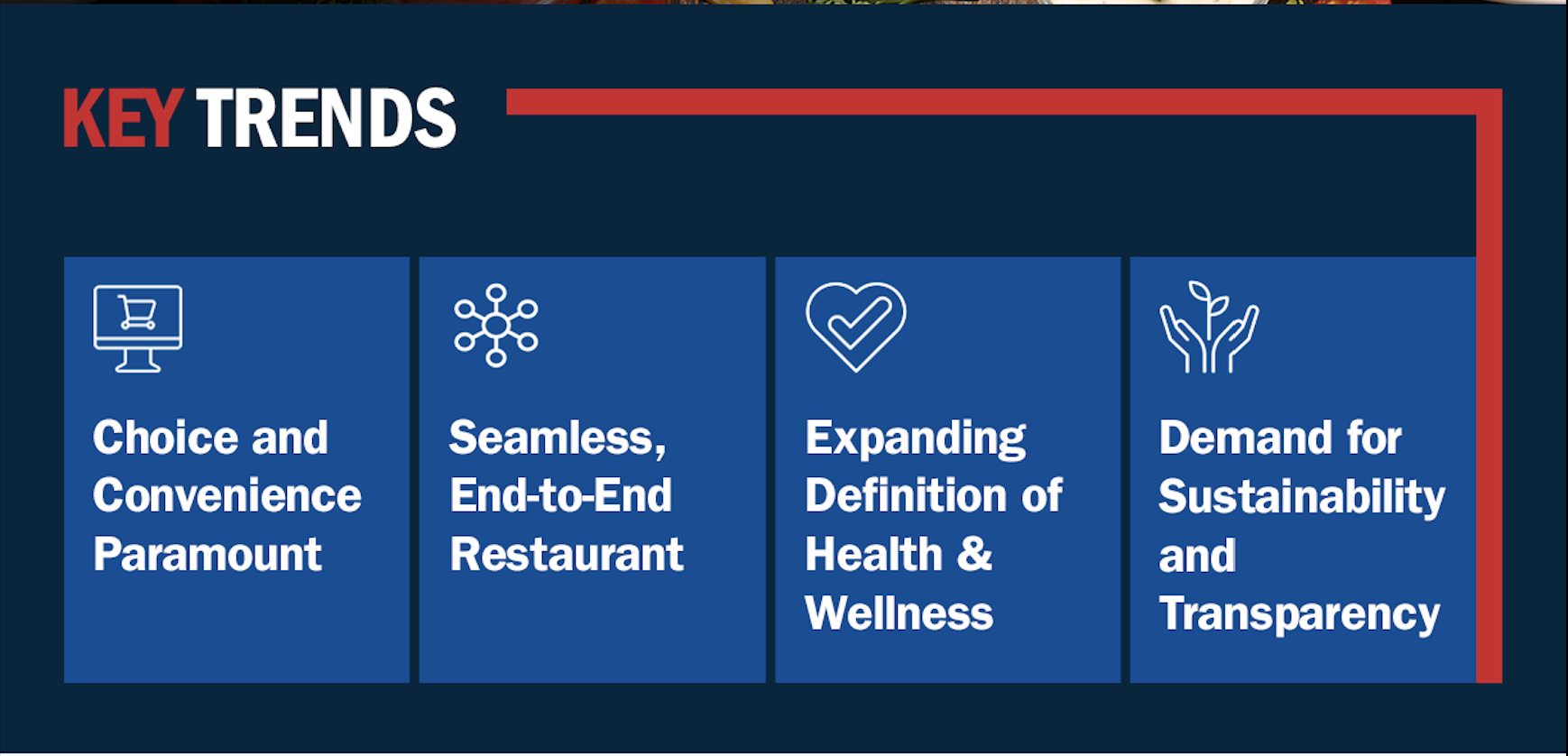

The pandemic undoubtedly changed the dining landscape, accelerating the digital transformation and shift to off-premise. Consumers are more accustomed than ever to the conveniences of digital ordering, curbside pickups, and contactless delivery. While current elevated levels of off-premise mix should taper slightly as the economy opens, sales are expected to stabilize at levels above pre-COVID. Brands are racing to enhance the consumers’ total digital experience with integrated and frictionless platforms as well as hyper-personalized and more connected interaction via loyalty programs.

Large, well-capitalized chains are looking to sustain their share gains during the past year. In addition to digital and off-premise, brands are investing in food and beverage innovation, improved product quality and everyday use. Regrowing in-store traffic is a key area of focus as restaurant visits are still not back to pre-pandemic levels. With lines between day parts further blurring the past year, some chains are looking to expand beyond the core. Breakfast away from home could see a resurgence on increased consumer mobility.

Fast-food chains snapped back from COVID-19 quickly as they benefitted from prior investments in drive-thru, takeout and delivery. Big pizza brands outperformed independent shops in 2020 and maintained their strong growth in 1H21. Chicken remained popular with several major chains joining the “chicken sandwich wars” in the recent months. Coffee is slowly picking up following a tough 2020 on the lack of morning commuters.

Casual dining has been losing market share to quick service for years and the pandemic accelerated that shift. Sales for casual dining chains plummeted -27% and unit count shrank by more than 5% during 2020,(2) fueled by dine-in restrictions, lack of drive-thrus, and less-developed take-out and delivery programs. Many larger brands are seeing sales recover in 1H21 as they lean into their core, simplify menus, and build off-premise channels as consumers look for an in-person dining experience.

Online food delivery exploded in 2020 thanks to stay-at-home orders. With the growth, the industry continues to be competitive, and the three major providers are spending heavily on promotions and advertising to attract new and “promiscuous” customers. The competition has also led to consolidation, with Uber acquiring Postmates and Grubhub being sold to UK-based Just Eat Takeaway.com.

1 Black Box Intelligence | 2 Technomic

Please contact the FOX Portfolio Strategy & Solutions team to help you with strategic marketing intelligence, insights and solutions.

STEPHANIE CHUA | Director, Portfolio Strategy & Solutions | stephaniekline.chua@fox.com

JEFF FOSTER | Senior Manager, Portfolio Strategy & Solutions | jeff.foster@fox.com

RISTEN CLARKE | Specialist, Portfolio Strategy & Solutions | risten.clarke@fox.com